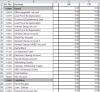

Books of account

Books of account

Petty cash voucher used by a sole trader small business for recording not authorisation. C-65881

Members

Formal petty cash claim and authorisation form for the corporate accountant. C-90156

Members

Policy statement describing a business trip, rules for athorisation of business trips, business expenditure while on a business trip, etc. C-53316

Members

Blank Purchase Order for buying a product with a product number and a unit price excluding GST. C-26315

Members

A blank Purchase Order for buying a product with a product number and a unit price excluding GST. C-17754

Members

Purchases Day Book allowing small companies to get the BAS right on an accrual basis without having to do the full accounting process. C-86850

Members

A simple model for planning the remuneration package for the board of a company limited by guarantee. (GLBG) C-42061

Members

Sales Day Book for small business to get the BAS correct at the end of the month. C-19270

Members

Sales Day Book allowing small companies to get the BAS right on an accrual basis without having to do the full accounting process. C-65354

Members

An expanded worksheet Statement of Cash Flows based on the chart of accounts for a company limited by guarantee. C-22088

Members

Statement of Cash Flows based on the Chart of accounts for an NGO National Council Ltd. C-93531

Members

Statement of Cash Flows based on the Chart of accounts for a company Ltd or Pty (public or private). C-93852

Members

10-column EOY worksheet (MSExcel spreadsheet) based on properly developed chart of accounts for a company Ltd or Pty (public or private) trading in goods. C-13748

Members

A detailed 10-column EOY worksheet used in preparation for publication of Financial Report. C-97714

Members

Detailed 10-column EOY worksheet (MSExcel spreadsheet) based on properly developed chart of accounts for a non-profit NGO organization. C-32647

Members

10-column EOY worksheet (MSExcel spreadsheet) based on properly developed chart of accounts for a small business trading in services. C-96245

Members

A little package for small professional consultants. C-39477

Members

A Trial Balance (in MSWord) based on the Chart of accounts for a company Ltd or Pty (public or private). C-91188

Members

A Trial Balance (in MSExcel) based on the Chart of accounts for a company Ltd or Pty (public or private). C-35187

Members

A Trial Balance (in MSExcel) based on the chart of accounts for an NGO Charity Ltd (above). C-75899

Members

A Trial Balance (in MSWord) based on the chart of accounts for an NGO Council Ltd (above). C-85772

Members

Trial Balance based on the chart of accounts for an NGO Council Ltd. C-92708

Members

A Trial Balance (in MSExcel) based on the chart of accounts for a small business involved in providing services. C-15333

Members

Simple 10-column worksheet (sole trader) balances as per the ledger at the end of year (EOY). C-21174

Members

10-column worksheet (partnership) MSExcel spreadsheet. C-67304

Members

Initial trial balance with balances as per the ledger at the end of year (EOY) and showing simple adjustments to the final figures. C-35624

Members

Initial trial balances for each company with balances as per the ledger at the end of year (EOY). C-27130

Members

The "worker payment record" as suggested by ATO's Record Keeping for Small Business May 2003. This Excel spreadsheet wages book is weekly for the year ended 30 June, 2004. It has 15 employees and a totals page with totals for the week and year to date. (C-63134)

Members

The "worker payment record" as suggested by ATO's Record Keeping for Small Business (May 2003). This Excel spreadsheet wages book is weekly for the year ended 30 June, 2007. It has 15 employees and a totals page with totals for the week and year to date. (C-48380)

Members

The "worker payment record" as suggested by ATO's Record Keeping for Small Business (May 2003). C-38595

Members

Chart of Accounts for a Pty Ltd Company using Xero, selling a product COGS. (C-09018)

Members

Chart of Accounts for a Doctors' surgery using Xero. (C-13032)

Members

Chart of Accounts for a farming partnership. (C-09020)

Members

Chart of Accounts for a farming partnership, like husband & wife, engaged in a piggery. (C-09021)

Members

Chart of Accounts for a farming partnership, like husband & wife, engaged in sheep & wool, using Xero. (C-09019)

Members

Pages

- « first

- ‹ previous

- 1

- 2

- 3