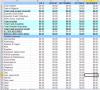

Books of account

Books of account

Annual report for a company limited by guarantee for a NGO (Federal). (C-60742)

Members

Annual report for an incorporated association registered under the Associations Incorporation Act (NSW) 1984. (See Chart of accounts and the final accounts worksheet from which it is derived!) C-46532

Members

This simple MSExcel spreadsheet work book helps you reconcile the Bank Ledger with your Bank Statement at the end of the month. C-39999

Members

Reconcilation of Cash Book with Bank Statement at the end of the month. C-21594

Members

For the small business that reports on a "Cash" basis. Fill in all receipts and payments for the month or the quarter into this journal and it will calculate your BAS Statement for you. C-70790

Members

For the small business that reports on an "Accrual" basis. Fill in all sales and purchases for the month or the quarter into this journal and it will calculate your BAS Statement for you. (C-45897)

Members

Simple, easy to complete, budget workbook for Last year, this year's budget and a page for each month. C-54749

Members

Budget workbook: Last year, this year's budget and a page for each month. C-49706

Members

Budget workbook: last year, this year's budget and a page for each month. C-38501

Members

Premium third party product. A kit designed for someone thinking of buying a new business. (M-98297)

Members

Planner for a business trip within Australia based on budget and actual to assist in planning next time around. C-10641

Members

A report prepared by the independent auditor to accompany the annual financial statements for a listed public company under s.301 Corporations Act 2001 in accordance with requirements laid out in s. 307. C-77468

Members

A report prepared by the independent auditor of the company to accompany the annual financial statements for an unlisted public company. C-14397

Members

A report prepared by the independent auditor of the company to accompany the annual financial statements. C-81023

Members

Small PTY company lodging annual financial statements with ASIC because of special circumstances. (C-60323)

Members

A report prepared by the independent auditor under s.301 Corporations Act 2001 to accompany the annual financial statements in accordance with requirements laid out in s. 307. This one is prepared for a company limited by guarantee, which is required to report to ASIC in a manner which is similar to an unlisted public company. C-74373

Members

A report prepared by the independent auditor to accompany the annual financial statements for a large pty ltd (proprietary limited company) which is a disclosing entity. C-37652

Members

A report prepared by the independent auditor to accompany the half-year (six months) financial statements for a large proprietary limited (pty ltd) company which is a disclosing entity. C-67743

Members

A report prepared by the independent auditor to accompany the annual financial statements for a listed public company which is a disclosing entity. C-23242

Members

Report prepared by the independent auditor to accompany the half-year (six months) financial statements for a listed public company which is a disclosing entity. C-66249

Members

Independent audit report to accompany the annual financial statements. C-46406

Members

A report prepared by the independent auditor to accompany the half-year (six months) financial statements. C-32942

Members

Dedicated day book Car Expenses (Fuel excluded method). C-60359

Members

Daybook/Logbook (Fuel included) Method. C-92880

Members

Form for calculating car expenses based on the Cents per Kilometre method. C-43213

Members

Calculating car expenses (form) (Cents per Kilometre). C-75351

Members

A form for calculating car expenses based on the Logbook of Actuals (Fuel Excluded) method. C-12882

Members

A form for calculating car expenses based on the Logbook of Actuals (Fuel Included) method. C-15205

Members

Form for calculating car expenses based on the One Third of Actuals (Fuel Excluded) method. C-94029

Members

Calculating car expenses based on the One Third of Actuals (Fuel Included) method. C-51222

Members

Simple record of payments from a particular bank account. C-46746

Members

Simple day book keeping control of receipts being deposited into a particular bank account. C-90092

Members

Chart of Accounts for a partnership (State) operating in agricultural Australia. (C-57508)

Members

Chart of Accounts for an agricultural company. (C-74954)

Members

Chart of Accounts for a sole trader operating in agricultural Australia. (C-35740)

Members

Detailed chart of accounts for a company trading in goods, private or public, with a simple way of numbering the accounts. (C-52157)

Members

Special chart of accounts for an NGO Charity Ltd registered as a company limited by guarantee. (C-48445)

Members

Chart of accounts for an NGO Council Ltd registered as a company limited by guarantee. (C-49187)

Members

A detailed chart of accounts for a small business or a small company providing services and using MYOB or similar. (C-48915)

Members

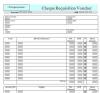

Control document for cheque payments. (AKA Payment voucher) C-86036

Members